The price of Solana’s SOL coin is primed to end July with a 30% monthly return and looks poised to challenge its yearly high of around $210 over the next few weeks.

While most of the community attributes SOL’s success to Solana’s memecoin euphoria, the network’s robust liquid staking ecosystem is emerging as a strong onchain narrative. Let’s look at how this current trend is developing on the Solana network.

Liquid staking tokens are leading Solana DeFi

Cointelegraph recently highlighted how Solana’s total value locked (TVL) jumped 10%, reaching $5.42 billion. Consequently, transaction volume increased, and onchain activity rose.

Liquid staking projects Jito and Marinade were the leading protocols on Solana, registering a TVL rise of 40% and 30%, respectively, over the past month.

Liquid staking is a process that combines the positives of staking and liquidity. Holders can stake their tokens in a smart contract or staking pool and receive a token representing their staked SOL.

This token is referred to as a liquid staking token (LST) and can be used to derive yields on other protocols or utilized in decentralized finance applications. For Jito and Marinade, these tokens are JitoSOL and mSOL, respectively.

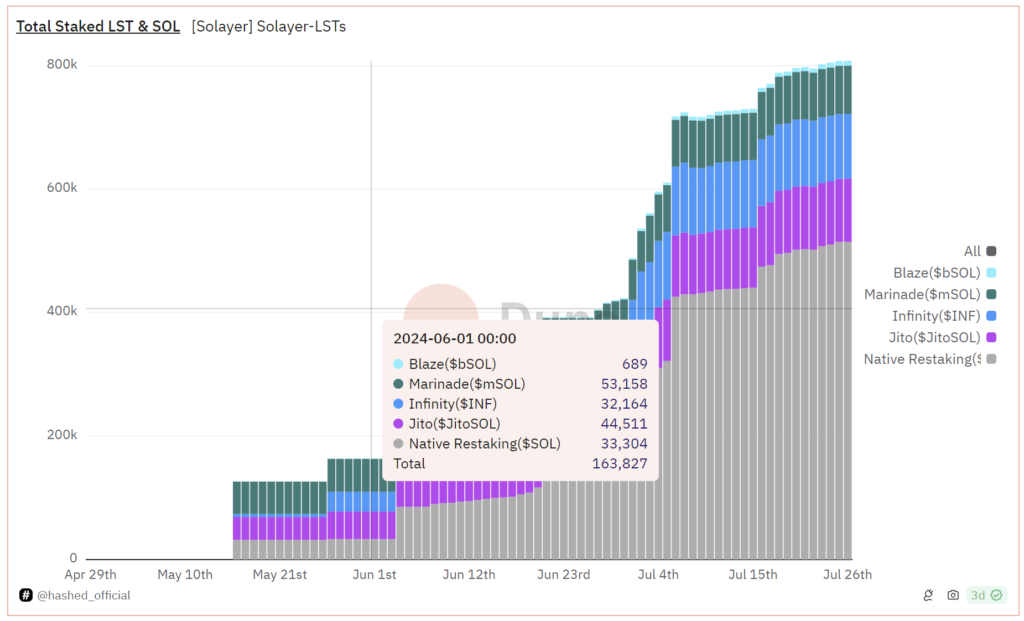

Data from Dune Analytics highlights that the total amount of SOL deposited in liquid staking derivatives more than doubled in 2024. Staked LSTs rose from 163,827 to 807,712, a 393% uptick between June 1 and July 26.

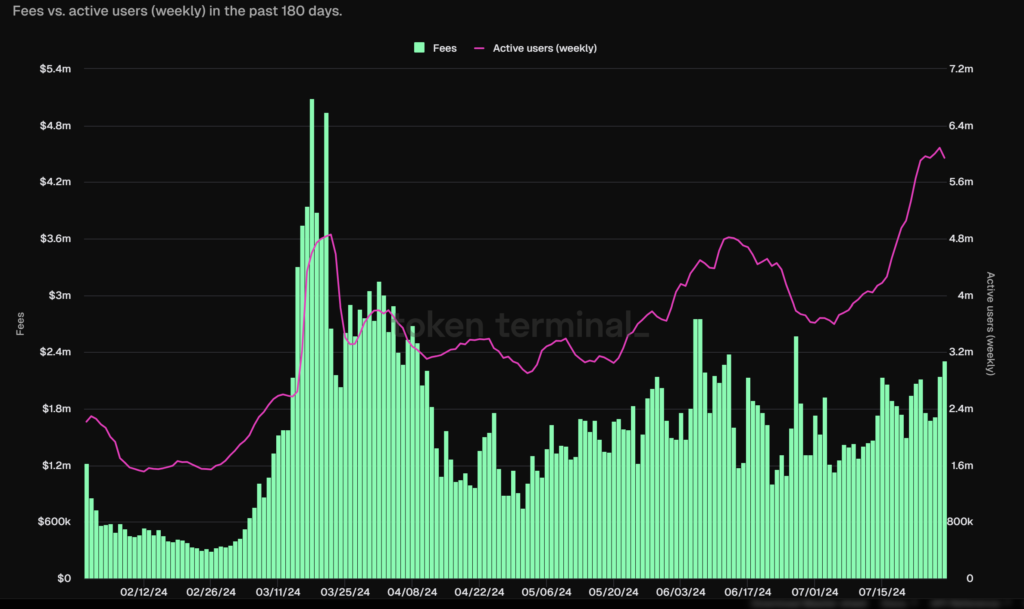

Data analytics platform Token Terminal also suggests that Solana’s daily and weekly active users are up 21% and 59%, respectively. The rise in active users is simultaneous with the rise in TVL for Jito and Marinade, as highlighted above. Hence, it can be inferred that memecoins are not the only sector currently bringing users to the Solana network.

Will SOL reach a new yearly high this week?

SOL’s price action shows bullish momentum, and the community expects the price to retest its yearly high at $210. At the time of publication, SOL had breached a bullish double-bottom pattern, with current overhead resistance at $202.

The overhead resistance is fairly weak, and there is a high probability of a yearly high retest. However, Solana is currently witnessing a correction, falling below the $190 mark.

If Solana continues to follow a bullish trend, its immediate retest target remains in the $200–$210 range. Conversely, if it loses its immediate support zone at $180, the altcoin may retest its previous swing low price at $165.

Meanwhile, options trader Trader Wick, is leaning bullish, saying that SOL/USD is once again leading the crypto market rally.